Agricultural Industry Manufacturers, Suppliers & Companies

-

DSS Steam Trap Manufacturer was established in 2008, after noticing ongoing problems in the industrial manufacturing markets due to the failure of conventional mechanical type steam traps. These products were costly, would fail regularly and cost ...

-

Bertin Technologies is a French industrialist in scientific instrumentation that designs and manufactures, in France and in Europe, measurement, observation & detection systems and instruments for critical applications. Every day, Bertin ...

-

Founded in 1981, the HRS Group operates at the forefront of thermal technology, offering innovative and effective heat transfer products worldwide with a strong focus on managing energy efficiently. For 40 years, HRS products and systems have been ...

HRS - Model AS Series - Thermblock Annular Space Pasteuriser Sterilisers

The HRS Thermblock AS Series is a packaged annular-space pasteuriser and steriliser solution for thermal treatment for pasteurising and sterilisation of food products with high viscosity in the food industry for aseptic filling processes or any ...

CONTACT SUPPLIER -

At CO2Meter, we hold over 30+ years of gas sensing solution expertise.We provide 250+ gas sensor solutions that are used in applications across the globe. Devices use the latest, innovative technology at their core. We take the time to test and ...

CO2Meter - Model RAD-0501 - Day Night CO2 Monitor & Controller for Greenhouses

The Day/Night CO2 Controller can be used in greenhouses, grow rooms, hydroponics rooms, and other places where elevated carbon dioxide levels are used to maximize plant ...

CONTACT SUPPLIER -

Founded in 1957, the Myron L Company is one of the leading manufacturers of water quality testing instruments in the world. Because of our commitment to customer satisfaction and product improvement, you have our assurance that any changes will be ...

Myron L® - Handheld Hydroponics Meters, Monitors and Kit

The nutrient solution and its management are the foundation of a successful hydroponics system. The function of a hydroponics nutrient solution is to supply the plant roots with water, oxygen and essential mineral elements in soluble form. ...

CONTACT SUPPLIER -

Cornell Pump Company in Clackamas, Oregon, is a trusted manufacturer of high-quality pumps that have been designed in the USA, manufactured in the US with imported parts, and assembled in Portland, Oregon, and Vancouver, Washington. With nearly 80 ...

Cornell - Model 4414T-F16 - Cutter Pump

The 4414T pump is designed with Cornell’s renowned quality and durability. It features a 4” discharge, 4” suction, and enclosed impeller. Available in All Iron or CD4MCu materials. Cornell’s patented Cycloseal® design is ...

CONTACT SUPPLIER -

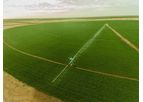

AFKO Pivot Irrigation Systems is a global leader in advanced irrigation solutions. Based in Ankara, Turkey, AFKO specializes in providing state-of-the-art irrigation systems designed to enhance agricultural productivity while conserving water ...

AFKO - Small Center Pivot Irrigation System

This system consist of many spans connected to each other by mobile connection, all spans move and rotate around a fixed center. Every two spans are connected by a multidirectional joint allowing the formation of an angle of up to 30 degree. Thus ...

CONTACT SUPPLIER -

Siebtechnik Tema is our global umbrella brand of Siebtechnik GmbH and the former TEMA Group. SIEBTECHNIK TEMA is part of a globally operating group of companies with around 3,500 employees in more than 50 companies with a clear focus on the ...

SIEBTECHNIK TEMA - Double Roller Mill WS-L

The laboratory version of our two-roller mill is additionally equipped with a feed hopper, a base frame with collecting box and the control system, so that it is delivered ready for connection. Our Roller Mills have an innovative app control, a ...

CONTACT SUPPLIER -

Brentwood Water & Wastewater provides robust and cost-effective solutions to meet the diverse needs of the drinking water and wastewater markets. As a valuable knowledge base and a source for applications expertise, Brentwood has developed ...

ENEXIO - Model TAP160 - 2H Blackout Blinds (Light Traps) for Livestock Breeding

Rugged and Dirt Resistant: In livestock breeding it is often necessary not to let any light from outside get into the stables. This allows special night and day rhythms and artificial lighting to be effectively used. The answer here is for light ...

CONTACT SUPPLIER -

Water Storage Tanks, Inc. is an industry leader in providing American-made, hand-assembled above-ground water storage solutions through CorGal, TimberTanks, and tower options. Each tank is engineered site-specific with the mission of creating a more ...

-

Founded in 2002 in Lévis (Québec, Canada), Creaform is a world-class leader in 3D measurement technology as well as 3D engineering services. We develop, manufacture and distribute portable and automated 3D scanning solutions to thousands of clients ...

VXinspect - Quality Assurance Services

VXinspect helps you investigate the problems raised by QC and production by performing root cause analyses and implementing corrective actions quickly to limit ...

CONTACT SUPPLIER -

LIGAPAL is a company based in Cormontreuil, in the heart of CHAMPAGNE since 1964. For 57 years, LIGAPAL has been designing, manufacturing and marketing its innovative products, present in France and almost everywhere in the world, thanks to our ...

Ligapal - Simplified Aphrometer

The simplified Aphrometer is designed to check the pressure and the vacuum in the bottles of still wine (Bordeaux bottles, Burgundy bottles). Thanks to its sting this pressure gauge pierces corks and some synthetic corks, but it cannot pierce the ...

CONTACT SUPPLIER -

In the last decades IMKO established as leading manufacturer for TDR moisture measurement instruments. Get to know our experts for precise moisture measurement. We develop, produce and distribute state-of-the art measurement technology and sensors. ...

IMKO - Model HD2 - Trime-Pico - Mobile Reading Device for Soil Moisture Probes

You just want to quickly know how moist the delivered sand or gravel is? Or you want to check if the moisture of your material is right for the next process steps? Control your quality on-site. With the handy two-rod probe SONO-M1 and HD2 Mobile you ...

CONTACT SUPPLIER -

For over 40 years, Feucht Obsttechnik has been known for innovative products in fruit harvesting technology. We are a family company from Baden-Württemberg and have developed from an agricultural machinery workshop into a sought-after specialist for ...

Feucht-Obsttechnik - Model OB 80 R (Ride-on) - Fruit Picking/Collecting Harvesting Machine

With these harvesting devices, a significant increase in productivity can be achieved in the short juice fruit harvesting season, while at the same time increasing profitability. The OB 80 R is a self-driving picking machine for individual farms, ...

CONTACT SUPPLIER -

Flottweg is one of the worldwide leading solution providers in the field of mechanical separation technology. Our decanters, disc stack centrifuges and belt presses exclusively manufactured in Germany are the preconditions for high efficiency in ...

MoRoPlant - Model 20, 20+ and 40 - Mobile Container System for Liquid Manure Separation

From waste product to recyclable material: Liquid manure can be processed efficiently and cost-effectively with the MoRoPlant20 mobile container solution. The heart of the plant is the decanter from Flottweg. This enables farmers to achieve ...

CONTACT SUPPLIER -

Since AMS, Inc. was founded in 1942, our products have been used by individuals, businesses, universities, non-profits, and government agencies throughout the world for a wide variety of testing, monitoring, and sampling purposes. AMS primarily ...

AMS - Model 425.02 - 1 X 13-3/4 Inch Plastic Liner

1" X 13-3/4" Plastic Liner. A specially threaded top cap allows the liner to protrude 1-3/4" from the top of the probe body for easy removal without handling or disturbing the sample. The Reach-&-Grab removal system helps improve the integrity ...

CONTACT SUPPLIER -

UP Umweltanalytische Produkte GmbH is specialized in the development, production, marketing and sales of environmental analytical products in the areas of soilphysics, hydrology, plantphysiology and meteorology. We offer single measurement devices ...

Umweltanalytische-Produkte - Model Typ GS-15 - Fruit Texture Analyzer (FTA)

Fruit Texture Analyzer FTA Typ GS-15 with following features: Measurement range: 50..15000g, Non-repeatability: 0,5%, Speed of probe: 1..40 mm/sec, Maximum fruit-size: 120mm, Weight: 9kg, comes with necessary software for Windows XP or higher, ...

CONTACT SUPPLIER -

Since 1986 Atlantis has introduced innovative products that created industry standards in the landscape and rainwater sectors worldwide. We are the inventor of the Atlantis drainage cell and flat pack modular tanks that are in use in over 90 ...

Atlantis Gro-Wall® - Model 4.5 - Vertical Gardens with Irrigation and Anchoring System

Versatile Garden for users and designers. Designed specifically for vertical garden enthusiasts, Gro-Wall® 4.5 includes many new intuitive and constructive features that benefit both users and designers. New features include a revolutionary ...

CONTACT SUPPLIER -

We design and manufacture world-class gas analysis systems and emission monitoring solutions to measure gaseous emissions from industrial processes, gases released from natural sources into the atmosphere, and gases present in working environments. ...

-

Analytik Jena is a leading provider of high-end analytical measuring technology, instruments, and products in the fields of biotechnology and molecular diagnostics and high quality liquid handling and automation technologies. ...

Analytik Jena - Web Seminar Analyis of Dairy Products

In this web seminar Analytik Jena presents a variety of solutions for the chemical and biological analysis of dairy products. All technologies and methods are suitable for routine analysis in an industrial context as well as for special analysis ...

CONTACT SUPPLIER

Need help finding the right suppliers? Try XPRT Sourcing. Let the XPRTs do the work for you